On November 3, 2025, a small but vocal victory unfolded in the Township of Langley Council chambers. Council members unanimously backed a motion from Councillor Michael Pratt directing staff to begin removing dozens of maze gates and baffle barriers on Township trails. The change cost roughly $135,000 and followed sustained advocacy from cycling and accessibility groups. Residents welcomed the change and advocacy groups noted the significance of the motion. Pratt’s work on the maze gate file demonstrates his ability to research an issue, draft a motion, and secure support when he chooses to focus on a matter.

This raises an observation: I am not aware of him bringing forward a comparable motion on the Township’s tax or fee structure.

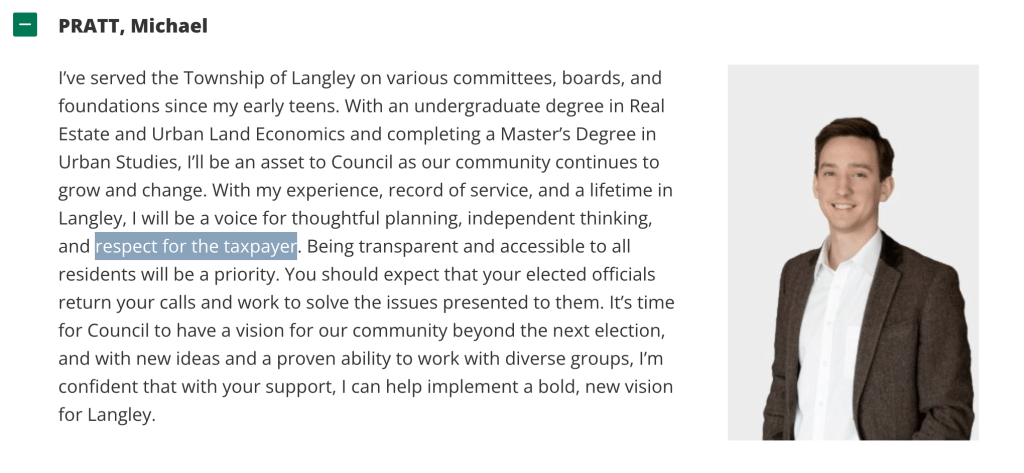

Pratt did not campaign as a backbencher or as a quiet vote for the status quo. In the 2022 election he branded himself as an independent. His candidate profile promised “thoughtful planning, independent thinking and respect for the taxpayer.”

Many residents appeared to accept that positioning at face value. His status as an independent was part of the public narrative. He was not officially part of Mayor Eric Woodward’s Contract With Langley slate and he appeared to be someone who might question large spending items or challenge ambitious growth strategies. His voting record over the past three years does not seem to reflect that independent stance.

The first sign came in committee and council meetings. He often came across as supporting key rezonings and growth decisions advanced by the Mayor’s group. In several instances he seconded key motions put forward by the mayor or other slate members. In others he chaired meetings when Woodward recused due to conflicts. For residents who expected more distance between him and the Mayor’s group, his voting pattern likely came as a surprise. The alignment that began informally was later confirmed formally. By late 2025, that alignment was announced.

Once Pratt aligned with the Mayor’s group, he was associated with the group’s fiscal decisions. The published financial reports provide a record of those outcomes.

Township financial documents show that council approved a 6.88% property tax increase for 2024. Then followed it with a 4.5% increase for 2025. The Municipality’s own charts show that Langley Township sits in the middle of the Metro Vancouver pack for combined municipal taxes and utilities. The Township also separated flat rate utilities from the property tax bill in late 2024 which created a new stand-alone July invoice that cannot be deferred by seniors. The change appears to have caused confusion and frustration in the community. I have not seen any public record of Pratt opposing the change or proposing amendments to address the impact on seniors.

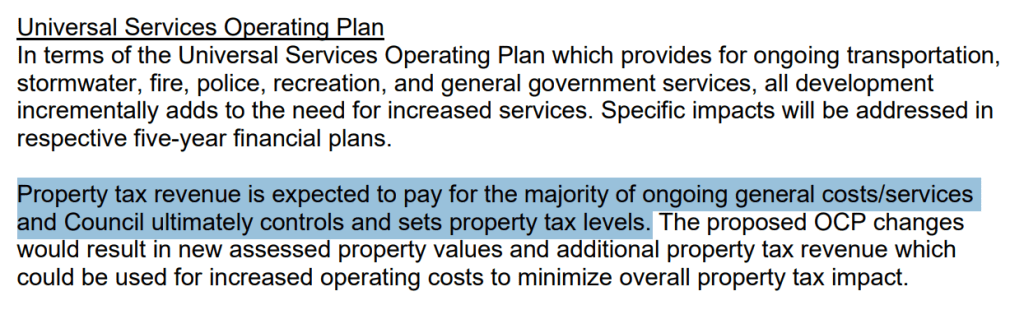

Staff reports also confirm that property tax revenue is expected to fund the majority of ongoing municipal services. The same report notes that successive changes to the Official Community Plan have a cumulative effect on long term fiscal plans. In practical terms this means that the Township’s strategy relies on forecasting property tax growth to manage the costs of maintaining existing, and expanding new, services and infrastructure. The decisions that carry fiscal weight are directly linked to property tax levels.

Across these decisions one pattern stands out. I am not aware of Pratt bringing forward motions to limit or reduce tax increases, introduce amendments on the utility split issue or seek a fairness review for condo owners. I am also not aware of him proposing an affordability motion tied to mill rate adjustments or phased capital spending.

His maze gate motion shows that he has the capacity to lead files when he chooses to. He can research a problem. He can even write a clear motion. He can move it through council and secure funding. He can do all of that when he chooses to. The unanswered question is why those skills have not been applied to an issue that affects every household in the Township. Respect for the taxpayer is not measured in trail gates. It is measured in the annual bills and in the long term costs created by the decisions of elected officials.

Pratt’s alignment with the Mayor’s group appears to have solidified during a period of above inflation tax increases. As the next election approaches, the key question is whether he will repeat the fiscal claims made in 2022 despite the tax outcomes of this term. The maze gates are coming down, the tax burden is not. Councillor Michael Pratt has not appeared to use those motion writing skills to pursue the taxpayer focused approach he seemed to emphasize during his campaign. The record is now clear enough for residents to assess for themselves.

Leave a comment