The Township says it is building nearly 250 new rental homes. The Mayor calls it proof that progress is finally happening on housing affordability. The Province calls it a milestone for its new BC Builds program. While this housing start is good news on the surface, a closer look at the numbers show that it barely makes a dent against the affordability crisis.

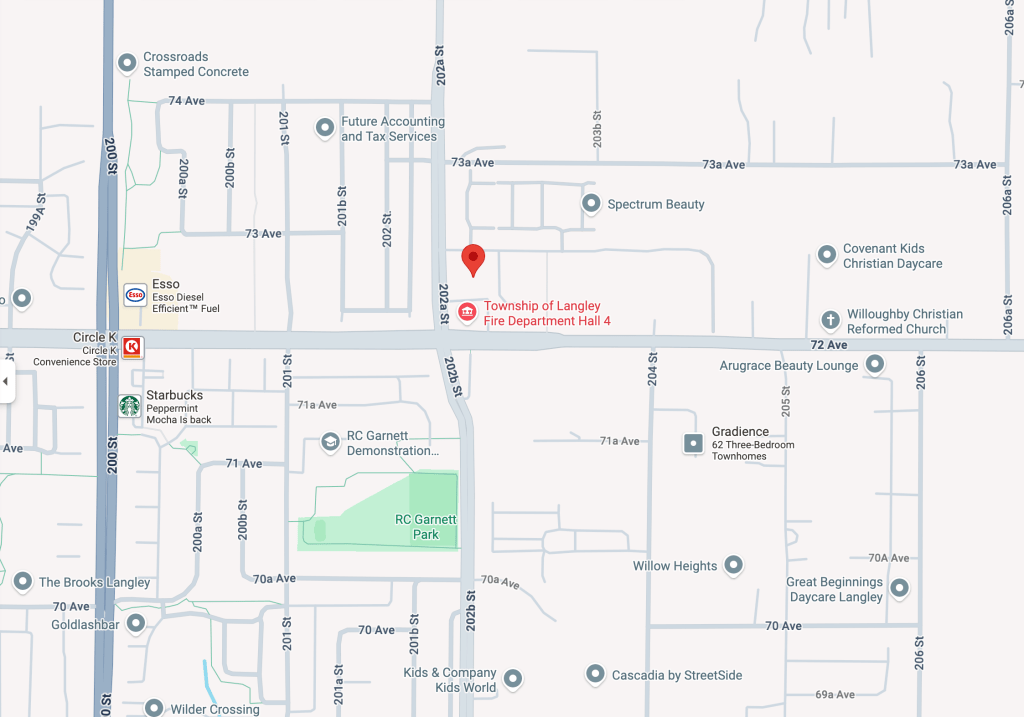

Two projects were announced this month under the BC Builds banner: 118 rentals beside the Willoughby Firehall and another 128 at the old Alder Inn site in Aldergrove. Both are being built on Township-owned land, now transferred into the newly minted Township of Langley Housing Trust Society. The Trust will own the buildings “in perpetuity,” which sounds noble enough. But the units themselves tell a smaller story.

Each project follows the BC Builds model: 70 percent of the homes will rent at full market rates. The remaining 30 percent will be about 20 percent below market, with tenants income-tested when they move in. That extra ten percent below-market share is what lets the Township claim it exceeds the provincial minimum. It does, technically. But most of these homes will still cost close to what every other new apartment in Langley costs.

The Township’s own news release says these projects will be ready in 2027. One in summer, one in fall. That means not a single tenant moves in for another two years, which may explain why the fanfare arrived early. By 2027, today’s below-market rents will likely look higher again, because the benchmark itself rises with the market. When rents climb, so does the floor that defines what counts as 20 percent off.

Township housing reports put the local need at over 14,000 new homes over five years. Even if we take this announcement at face value, 246 units amounts to less than two percent of that target. And only 30 percent of those are discounted at all. That means the number of genuinely cheaper units, about 74, could fit in a single mid-sized condo building.

The Mayor has framed this as proof of action. He isn’t wrong that something is being built. What he leaves out is that this program mainly helps middle-income renters who already earn enough to qualify. A two-bedroom at 20 percent below market still pencils out around $1,850 a month. You would need an after-tax income of about $74,000 to keep that under the 30-percent rent-to-income rule. For a lone parent or single worker, that is out of reach.

To the Township’s credit, the land contribution means the community keeps the asset, and the Housing Trust model is a good one. But it doesn’t magically make the units affordable to those who need them most. Public ownership guarantees long-term control, not low rent. Residents should watch the pre-leasing numbers when they come out and see how many families earning under $60,000 actually get a look in.

In fairness, progress in politics often comes by inches. This is a few inches forward. The danger is mistaking inches for miles. Calling these 246 rentals real progress for affordability is like calling a pothole repair a transportation strategy.

Leave a comment